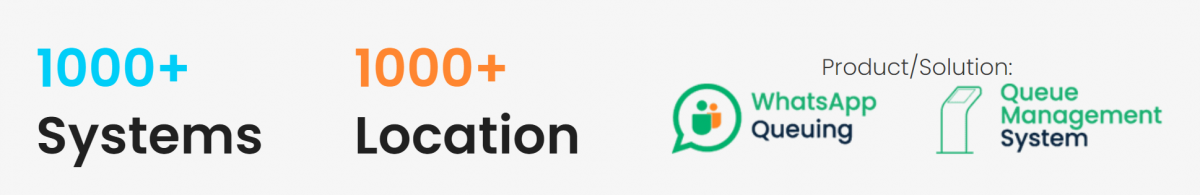

Banorte installs Wavetec’s

Customer Flow Management Solution

at 1000+ retail branches in Mexico

Background

With an average daily footfall of 400-500 customers per branch per day, and catering to a maximum of 800 customers per day at its large branches, Banorte faced the challenge of delivering seamless customer service to its customers.

Realizing that technology is a fundamental enabler of branch transformation and understanding the importance of placing the customer at the center of its operations, Banorte Bank initiated the Branch Transformation Project that is aimed at increasing efficiency and reducing costs while improving the customer experience using self-service technology and interactive tools.

With an objective to upgrade the Customer Service system at its retail banking branches, and effectively cater to its customers, Banorte sought a solution that could be customized according to its service model and would enable it to manage its customer flow seamlessly while reducing customer waiting times and optimizing employee productivity.

Through a technological reformation of its branches, Banorte aimed to build a new banking experience that would bring the bank closer to its customers in a sophisticated and welcoming environment with a seamless waiting experience.

The Solution

Wavetec, a leading manufacturer of queue management systems, proposed a turnkey solution to Banorte that would allow the bank to manage customer journeys efficiently. Wavetec’s robust management system is being deployed at over 1000+ branches throughout Mexico.

When customers enter the bank’s branch, they check themselves in at customized self-service kiosks. The kiosks are integrated with the bank’s system, all Banorte customers are identified when they insert their card in the card reader slot. They are prioritized according to their bank accounts and given a ticket accordingly.

For efficient service, there are LCDs installed at prominent areas of the branch that allow customers to see when they are next by checking their ticket numbers in the LCDs operated by Donatello, Wavetec Digital Signage.

When a customer’s ticket number is displayed on the LCD, customers walk to the service counter for their turn and are served accordingly.

The queue management system is synced with Wavetec Live Reporting System and Dashboards that present information relevant to key performance indicators of the branch, allowing the creation of actionable reports with the decision-making information.

Andoni de Mendieta Molina, Subdirector Branch Management and Innovation at Banorte stated:

The inclusion of the queue management system with a ticket-dispensing kiosk has changed the way we operate our branches. The benefits come mainly from three perspectives:

1. We have full control over the customer service quality, making sure we comply with the established service standards in the customer prioritization model.

2. Secondly, we utilize quantitative information to predict the demand we’ll have, which allows us to develop an adequate plan to adjust the service capacity accordingly and achieve an efficient process to minimize customers’ waiting time and reduce the idle time of our staff.

3. Thirdly, we have now implemented a service model based on differentiation, which allows us to prioritize our most loyal clients.

Banorte uses robust reporting software to generate custom reports to track the improvements in the waiting times of its customers. The bank’s management also uses the mechanism to change real-time calling logic based on the reports.

Management manages and adjusts the calling logic at different times of the day depending on the dynamic customer inflows, allowing the branch to maintain the KPIs related to customer service.

The queue management dashboard allows the management and directors at Banorte to monitor the status of their branches in real-time.

The system also allows them to generate historical reports that can be extracted in excel as well. When one of the bank’s branches reports a problem with queuing, the management checks Wavetec’s Dashboard that displays real-time information.

Results

Wavetec’s system has helped Banorte by prioritizing the attention of the bank’s customers, reducing waiting times, and making waiting more pleasant as customers do not have to physically stand and wait in queues for their turn. Customers comfortably sit in the waiting area and wait for their turn according to their ticket number hence the waiting process is fair and transparent.

Wavetec’s advanced queuing solution has also enabled the bank to monitor customer footfall and customer service at their branches. Real-time actionable insights provided by Wavetec’s Reporting software and dashboards help the bank devise strategies to prioritize the attention of its premium customers.

The Subdirector Branch Management and Innovation further stated: The queuing system gives us the necessary visibility to better manage our resources and deliver the service we desire. It also allows us to put into practice the concept of care designed for our priority clients.

The Wavetec's Experience

Wavetec is a leading global company in the domain of queue management systems for the banking sector. This can be seen in the successful queue system installations and system integrations in large banks such as Interbank, Lloyds Bank, Kenya Commercial Bank, Royal Bank of Scotland, Samba Bank among others.

Grupo Financiero Banorte (GFNorte) offers a wide variety of products and services through its bank, brokerage house, pension and insurance companies, Afore, investment funds, as well as the leasing, factoring and storage companies. At the end of June 2018, measured by its assets, Banorte is already the second-largest financial group in Mexico.

Banorte is the main provider of loans to governments and the second most important bank in mortgages and has consolidated its position as one of the most profitable banks in Mexico, being recognized for its solid fundamentals by showing good asset quality, as well as as a strengthening in its level of capitalization.

Banorte is the only commercial bank, among the six largest institutions, that is managed by a Mexican management team. Its decisions are made locally without the influence of foreign matrices, which has proven to be an advantage given the recent weakness of many global institutions.